1500 paycheck after taxes

After tax take home pay is 12500 per month. For example if an employee earns 1500 per week the individuals.

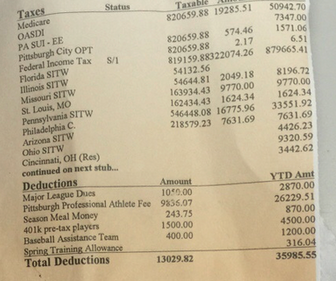

Sb Nation On Twitter Andrew Mccutchen S Pay Stub Includes A Looooot Of Taxes Http T Co Uukmdzxpqg Http T Co 7ol9cmha7q Twitter

Enter your annual salary or earnings per pay period.

. After tax take home pay is 2885 per week. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. A financial advisor in Pennsylvania can help you understand how taxes fit into your overall financial goals.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. About 1500 A Month After Tax In United States. If your income is 1500 15k a year your after tax take home pay would be 150000.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Federal income taxes are also withheld from each of your paychecks. Gross Salary - Income Tax After deductions 150000.

Your average tax rate is. How Your Texas Paycheck Works. 1500 after tax is 1500 NET salary annually based on 2022 tax year calculation.

The average monthly net salary in the UK is around 1730 GBP with a minimum income of 1012 GBP per month. - 000 National Insurance. Now find the tax value by multiplying.

It can also be used to help fill steps 3 and 4 of a W-4 form. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. - 000 Income Tax.

That means that your net pay will be 43041 per year or 3587 per month. This places US on the 4th place out of 72 countries in the. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

How Your New Jersey Paycheck Works. Youll then see an estimate of. Employer Superanuation for 2022 is payable on all employee.

Financial advisors can also help with investing and financial planning -. 1500 after tax breaks down into 12500 monthly 2875 weekly 575 daily 072 hourly NET salary if. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

75100 0075 tax rate as a decimal. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Your employer uses the information that you provided on your W-4 form to.

Your employer withholds a 62 Social Security tax and a. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To easily divide by 100 just move the decimal point two spaces to the left.

Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. Firstly divide the tax rate by 100. After tax take home pay is 577 per day.

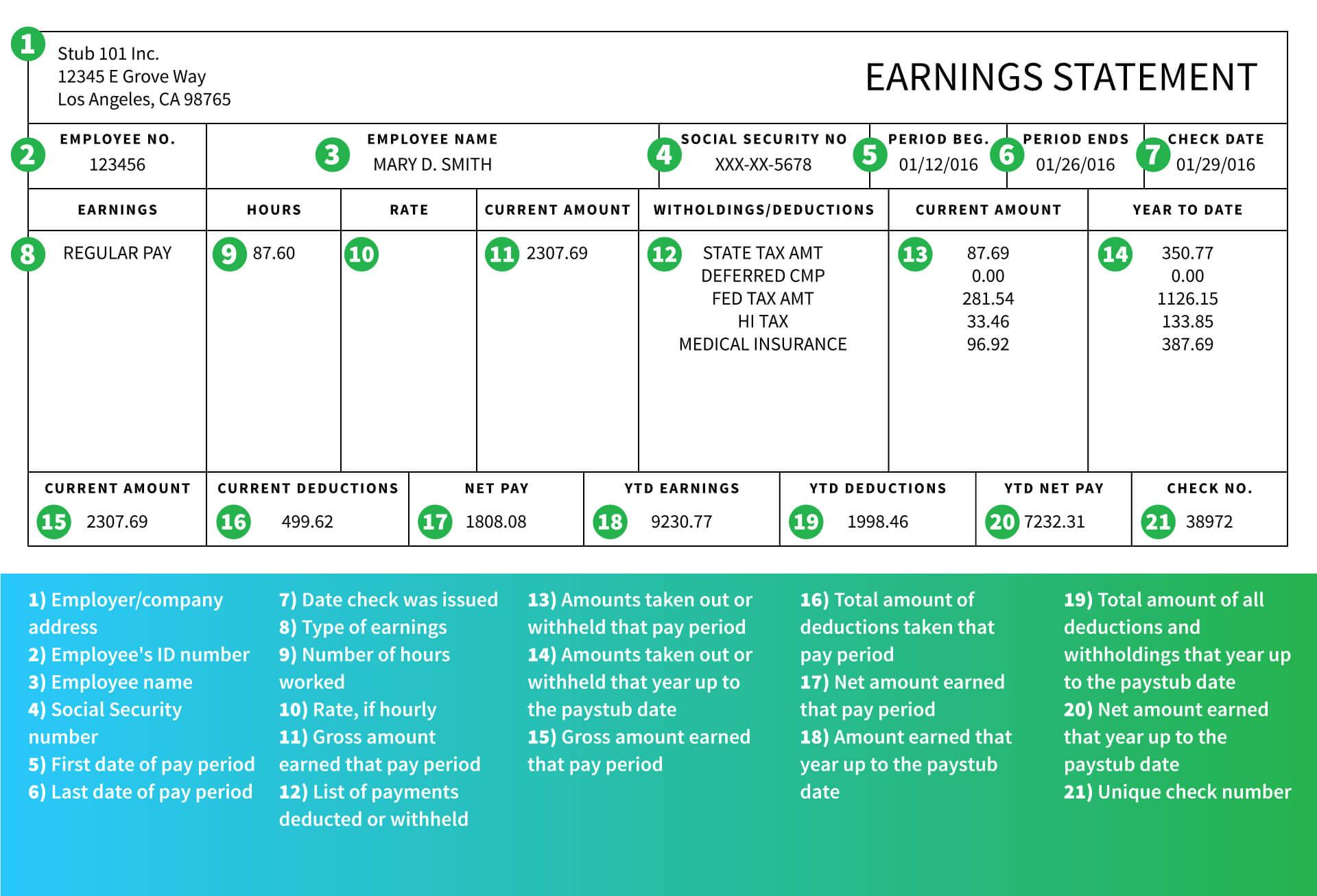

How To Read A Pay Stub Gobankingrates

I Owe My Employer 1500 For Their Payroll Deduction Error R Antiwork

Paystub Calculator Check Stub Maker

Employer Cannot Profit From Unclaimed Employee Paychecks Wage Hour Defense Blog Printable Checks Payroll Checks Payroll Template

The Importance Of Federal Tax Compliance For Businesses

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

1 500 After Tax Us Breakdown September 2022 Incomeaftertax Com

Ms Naira What Are Payroll Taxes Taxes That Are Deducted From Out Paycheck Are Called Payroll Taxes Employers Must Do So By Law Payroll Taxes Include Ppt Download

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Additional Payroll Reports Asap Help Center

What Does Retroactive Pay Mean Workest

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Pin On Documents

Paycheck Budget Spreadsheet Google Sheets Budget Planner Etsy In 2022 Budget Spreadsheet Budget Planner Budget Planner Printable

Ms Naira What Are Payroll Taxes Taxes That Are Deducted From Out Paycheck Are Called Payroll Taxes Employers Must Do So By Law Payroll Taxes Include Ppt Download

The Anatomy Of An American Paycheck Millionaire Before 50

California Paycheck Calculator Smartasset